As we approach the end of March, and the financial year for some, I find myself saying this every year: time is flying! However, 2025 is shaping up to be even busier than the last, which is hopefully a positive sign for all of us in business.

Office Update 💻

Steph is our Office Manager and Executive Assistant Team Leader took three weeks off in February to celebrate her beautiful wedding to Jordan in the Wairarapa, congratulations to them both.

This year has brought many new clients our way, most of whom were referred by our existing clients—thank you for spreading the word! I often say it takes a village to run a business, and we love being part of yours. The Summit Outsourcing community continues to grow through both the referrals we receive and those we give. Whether we still work together or not, we’re always happy to connect and recommend great businesses run by passionate people. If you need support outside our services, let us know—we’ll connect you with the right people.

What’s Inside This Edition 👀

We’re sharing a business tips, important updates on payroll and employer tax deduction changes taking effect from 1 April 2025 and a general update

Importance of a Budget 💰

If you don’t already have a budget in place and your financial year starts on 1 April 2025, now is the time to get this done. As a business owner, staying on top of your numbers is crucial—tracking your progress and making adjustments throughout the year can make all the difference. If you need support, reach out to your Client Manager to get started.

Take care, and if you need anything or just want to catch up, give me a call – 027 620 0296 📞

Important changes – Tax and payrate changes from 1st April

- myIR and 2 factor authentication

From 1st of April 2025 the IRD are introducing 2FA when accessing your myIR accounts. This will change how we can access your myIR accounts.

We have now linked your myIR accounts to ours, as we are a nominated person. Going forward, this is how we will access your relevant tax information.

Here’s a breakdown of the key payroll changes coming in 2025:

- Minimum Wage Increase:

- The adult minimum wage will rise to $23.50 per hour from 1st April 2025.

- Starting-out and training wages will also increase to $18.80, maintaining their percentage relative to the adult rate.

- ACC Earners’ Levy Changes for 1st April:

- The ACC earners’ levy rate will see a slight increase of 7 cents for every $100 of liable earnings.

- The maximum earnings threshold for this levy will also increase from $142.283 to $152,790 with the maximum levy payable set at $2,551.59. Earnings above $152,790 will not be subject to an ACC earners levy.

- The minimum earnings on which self-employed individuals pay Work and Earners levies will increase to $49,365.

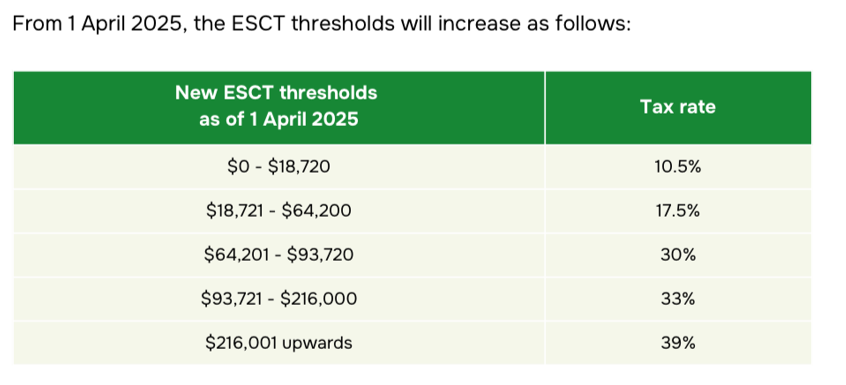

- ESCT (Employer Superannuation Contribution Tax) Changes:

- There will be adjustments to the ESCT threshold and rates. ESCT relates to the amount of tax an employer pays on an employee’s Kiwisaver contribution.

- Taxing Lump Sum Payments:

- Changes are coming to how lump sum payments, particularly final pays, are taxed when employment ends. The tax calculation will be based on the last two pay periods. This will affect the amount of tax deducted from an employee’s extra pay on termination, which may be higher or lower than before.

- Fringe Benefit Tax (FBT) changes:

- There will be changes to FBT calculation methods, and FBT thresholds will also change. New FBT thresholds will apply for final quarter returns (1st Jan – 31st March 2025)

Key takeaways for you – as an employer:

- Ensure you have received correspondence from your payroll systems, and that they are updating systems to reflect these changes.

- Have a think about your staffs current payrates, review and adjust employee pay rates as necessary.

- Be aware of the changes to how lump sum payments are taxed, especially for departing employees.

It’s important to keep an eye on official updates from sources like the Inland Revenue Department (IRD) and Employment New Zealand for the most accurate and up-to-date information.

If you need any clarity on the above changes and how they may impact you, please contact Joy or Heidi and we are more than happy to talk through things with you.

Only 12 more days of the current GST period and the end of the 2025 financial year!

Do you have a tax agent sorted to present your financials and file your tax returns? Please talk to us and we are more than happy to refer you.

If you have any queries about current liabilities, you may have please contact us.

As always, our goal is to make your life easier and your business run smoothly. Here’s a quick reminder of the services we offer:

- Executive Assistance: Let us handle the details so you can focus on what matters most

- Bookkeeping: Stay on top of your finances with accurate, timely bookkeeping & CFO services.

- Payroll: Ensure your employees are paid accurately and on time with our payroll services.

- Office Management: From day-to-day operations to long-term strategy, we help keep your office running efficiently.

- Board Administration: We can assist with board meetings, minutes, and compliance so you’re always prepared. We also offer software and governance training.

If you’re looking for support in any of these areas, don’t hesitate to get in contact with us! We’re here to help your business thrive in the coming year, and we’d love to discuss how we can assist you or someone you know in achieving your goals